Single user license

Single Practioner

Product designed for single user accounts with access to Individual and Corporate tax returns at an affordable price.

Go to Pricing

Access to Individual and Corporation

Access to Individual and Corporate tax returns in one affordable package.

OCR tool

Optical Character Recognition (OCR) for uploading your reports

Technical Support

Technical Support is available Monday through Friday from 9:00 a.m. to 6:00 p.m. (Phone, Email, Remote Assistance).

File Online

E-file Puerto Rico Income Tax Returns

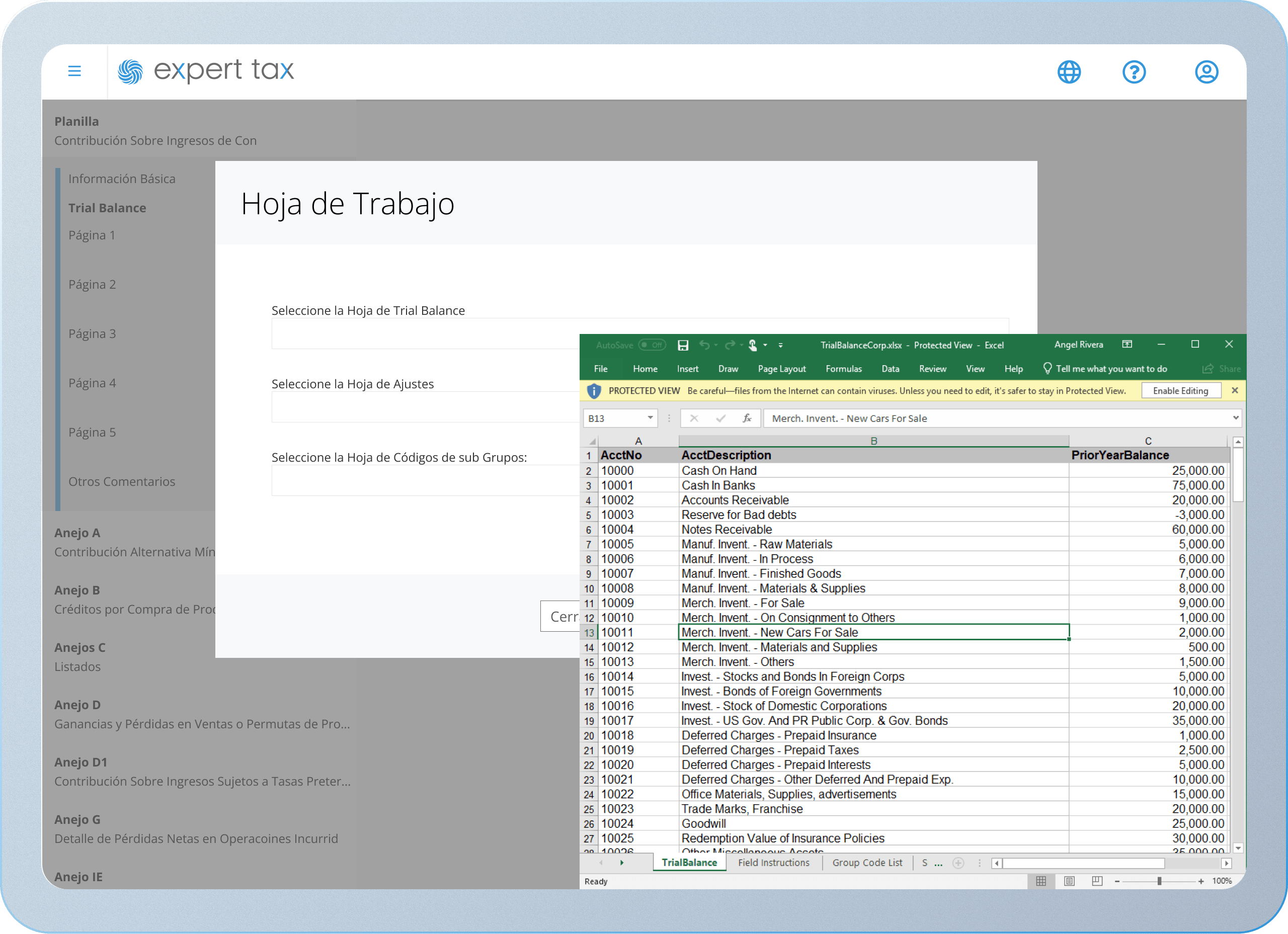

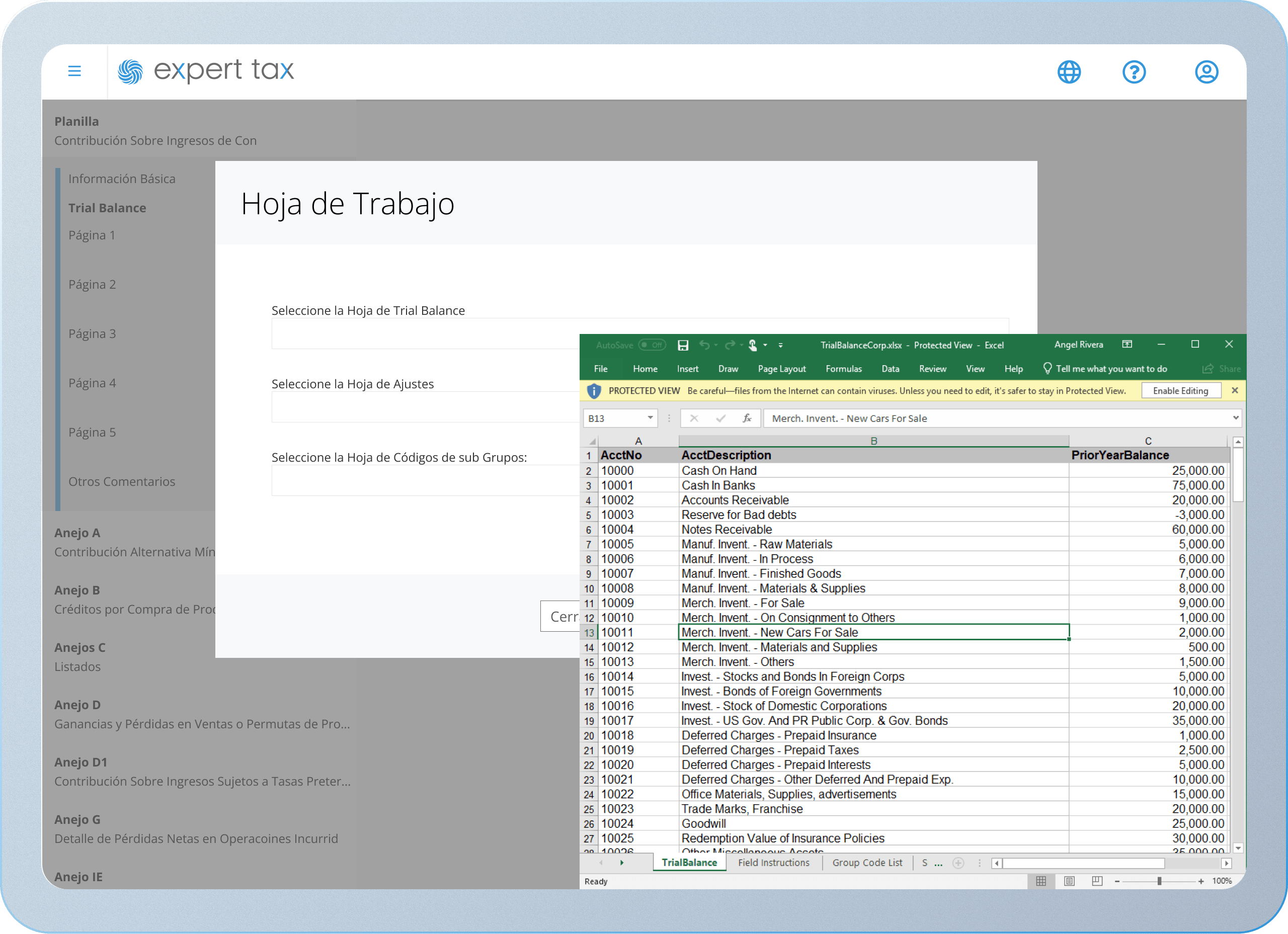

Trial Balance

The only ones who offer a Trial Balance feature to automate the tax form preparation process so you can prepare more returns in less time.

Federal Forms

Electronic filing of federal forms such as the 1040 and 1040SS for the child and self-employment credit.

File Online

E-file Corporation and Conduit Entity Income Tax returns.

Trial Balance

The only ones who offer a Trial Balance feature to automate the tax form preparation process so you can prepare more returns in less time.

Preparer

The most agile program for independent preparers

Electronic filing of Individual and Puerto Rico Corporation tax returns.

Access to Individual and Corporate tax returns in one affordable package.

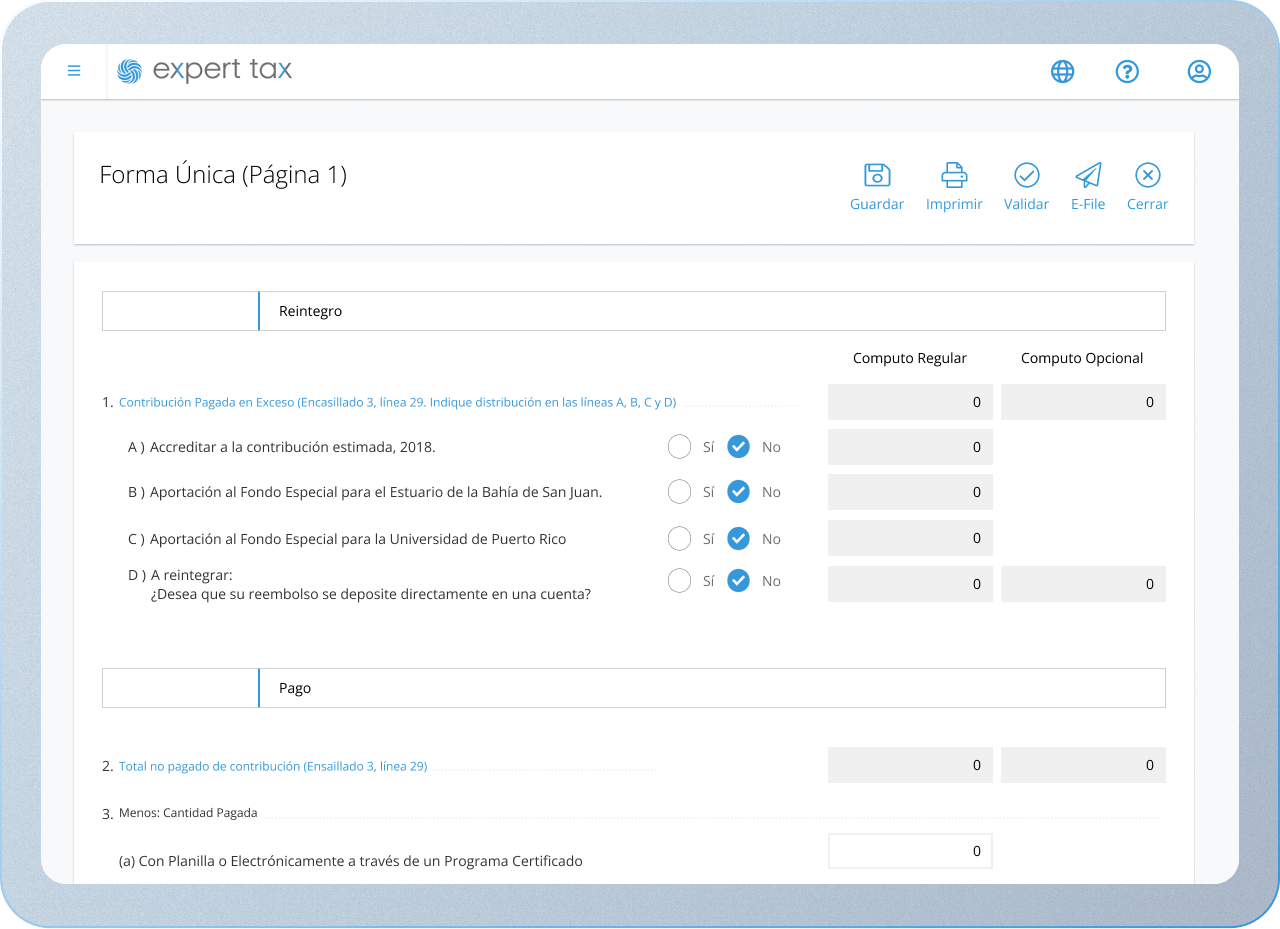

Tools to facilitate processes: OCR, Trial Balance, spreadsheet validation, optional and regular computation.

Features that make a difference

Streamline your processes

Discover the features that will take your firm to the next level.

Preparer Module

To fill out forms at an affordable price

Single Practioner

Electronic filing in an economic package with a limit of one user.

Filing cost varies per tax return.

Filing cost varies per tax return.

$

100/year

Payment plan available

482 - Individual Income Tax Return (Form 482)

480.2 - Corporation Income Tax Return

1040 SS: Federal Self-Employment Tax Return (Form 1040 SS)

480.2(EC) - Pass-through Entity Income Tax Form

Premium+ Independent Preparer

A more complete service that offers all the forms of the Individual and Independent Preparer module. Filing fee varies per return.

$

400/year

Payment plan available

All the forms of the Individual module: 482, VOB, etc.

480.2 - Corporation Income Tax Return

1040PR: Federal Self-Employment Tax Return (Form 1040-PR)

480.2(EC) - Pass-through Entity Income Tax Form

Electronic filing fees

Filing fees for independent preparers

Individual Forms

Price for filing

482: Individual Income Tax Return (Form 482)

$8.96/sheet

1040: U.S. Personal Income Tax Return (Form 1040)

$8.96/sheet

1040 SS: Federal Self-Employment Tax Return (Form 1040-PR)

$8.96/sheet

Independent Preparer Premium+ includes all the spreadsheets of the Individual module.

Other Spreadsheets

Price for filing

480.7OE: Income Tax Exempt Organization Information Form (Form 480.7OE)

26.90/sheet

480.2: Corporate Income Tax Return (Form 480.2)

$53.80/sheet

480.2EC: Conduit Entity Income Reporting Form (Form 480.2EC)

89.68/sheet

480.3(II): Income Taxes for Businesses with Tax Exemption Ordinances

$269.05/sheet

*Contributory years available: 2018, 2019, 2020, 2021, 2022, 2023.