Web application

Corporation Module

Prepares and files Puerto Rico corporate returns with advanced OCR and Trial Balance tools.

Pricing

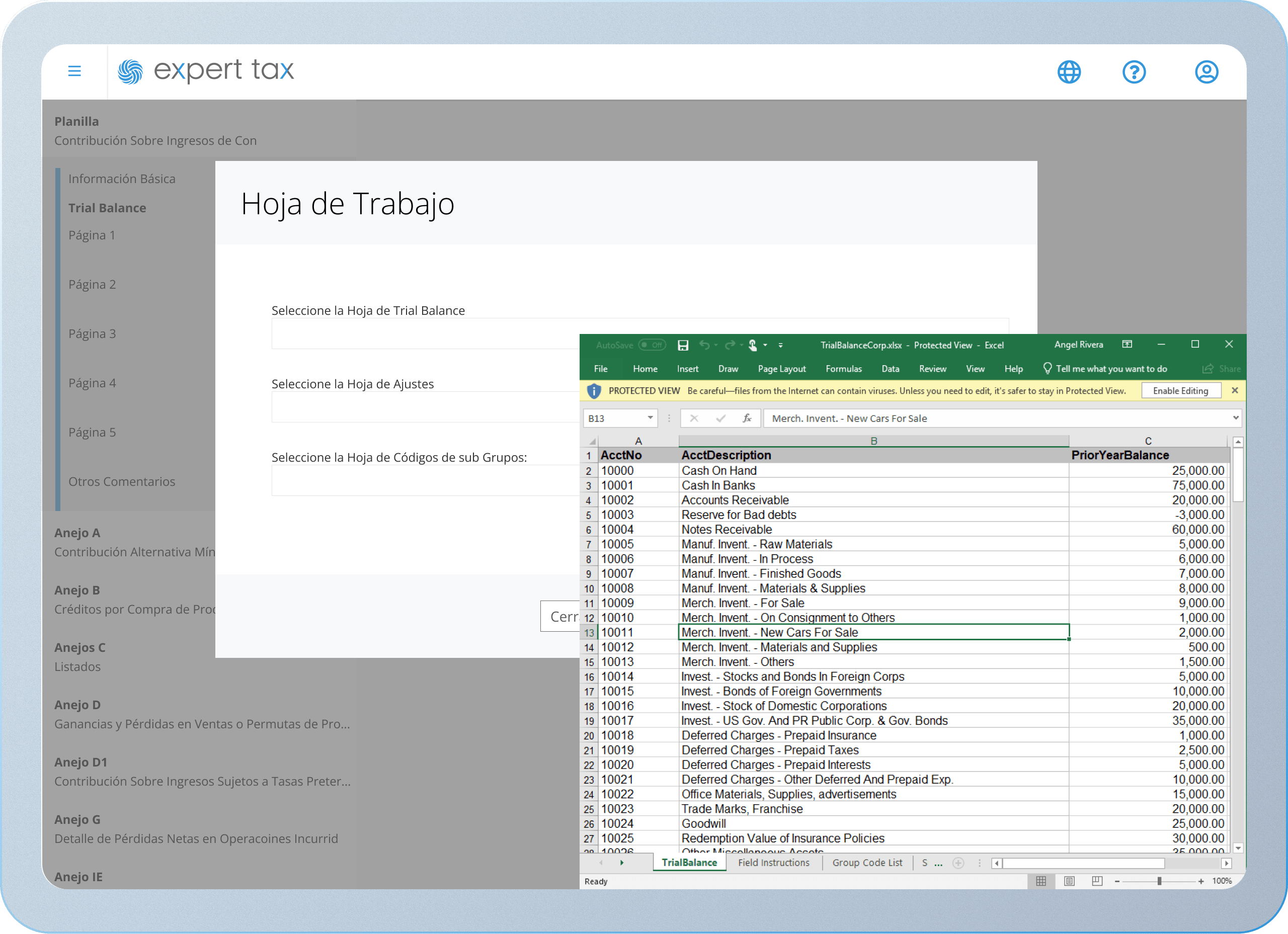

Trial Balance

The only ones who offer a Trial Balance feature to automate the tax form preparation process so you can prepare more returns in less time.

Industrial Incentives

If you are preparing Industrial Incentive Schedules, Professional Corporation is for you.

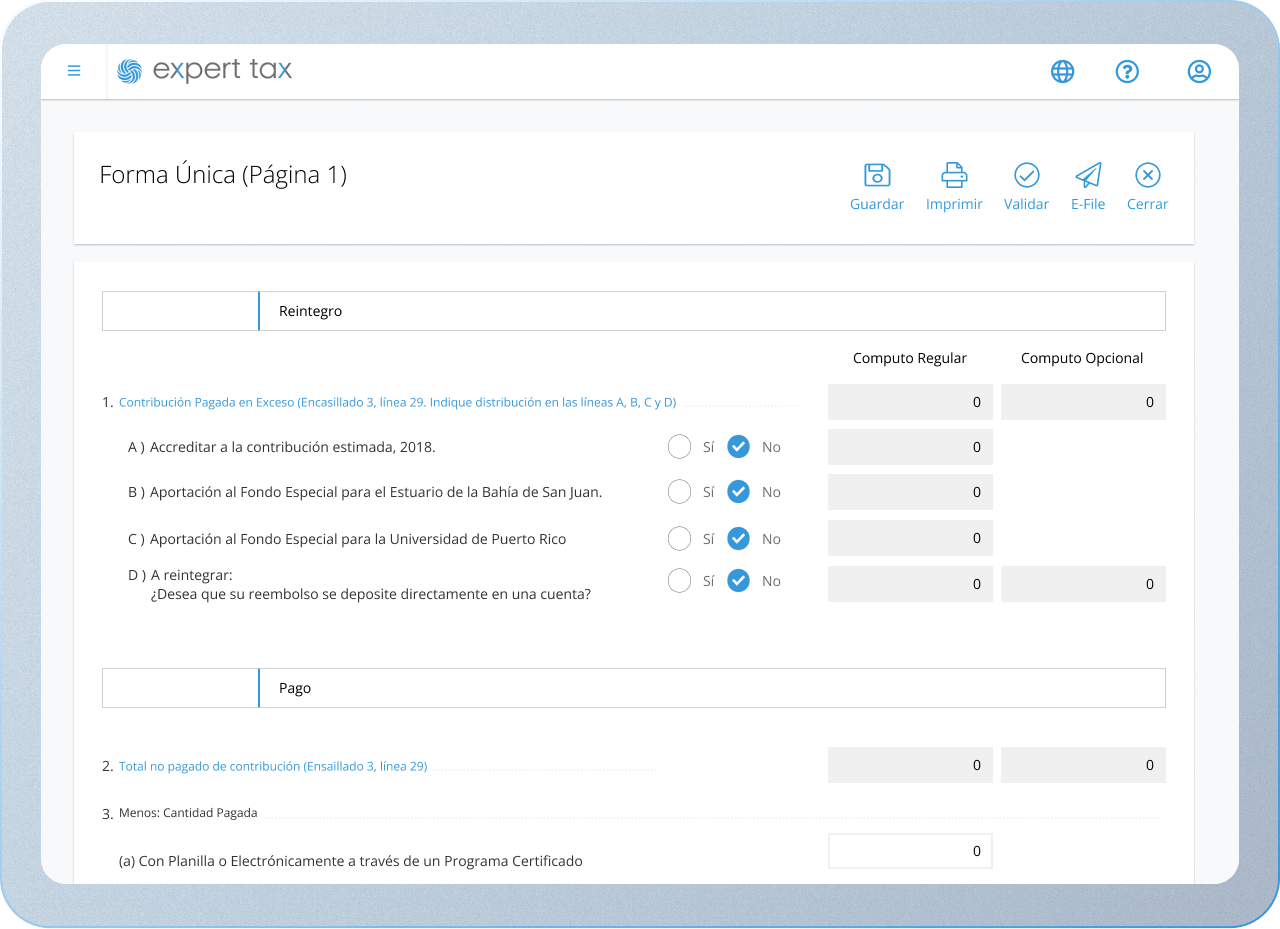

File Online

E-file Corporation and Conduit Entity Income Tax returns.

Industrial Incentives

If you are preparing Industrial Incentive Schedules, Professional Corporation is for you.

Trial Balance

The only ones who offer a Trial Balance feature to automate the tax form preparation process so you can prepare more returns in less time.

Industrial Incentives

If you are preparing Industrial Incentive Schedules, Professional Corporation is for you.

File Online

E-file Corporation and Conduit Entity Income Tax returns.

Trial Balance

The only ones who offer a Trial Balance feature to automate the tax form preparation process so you can prepare more returns in less time.

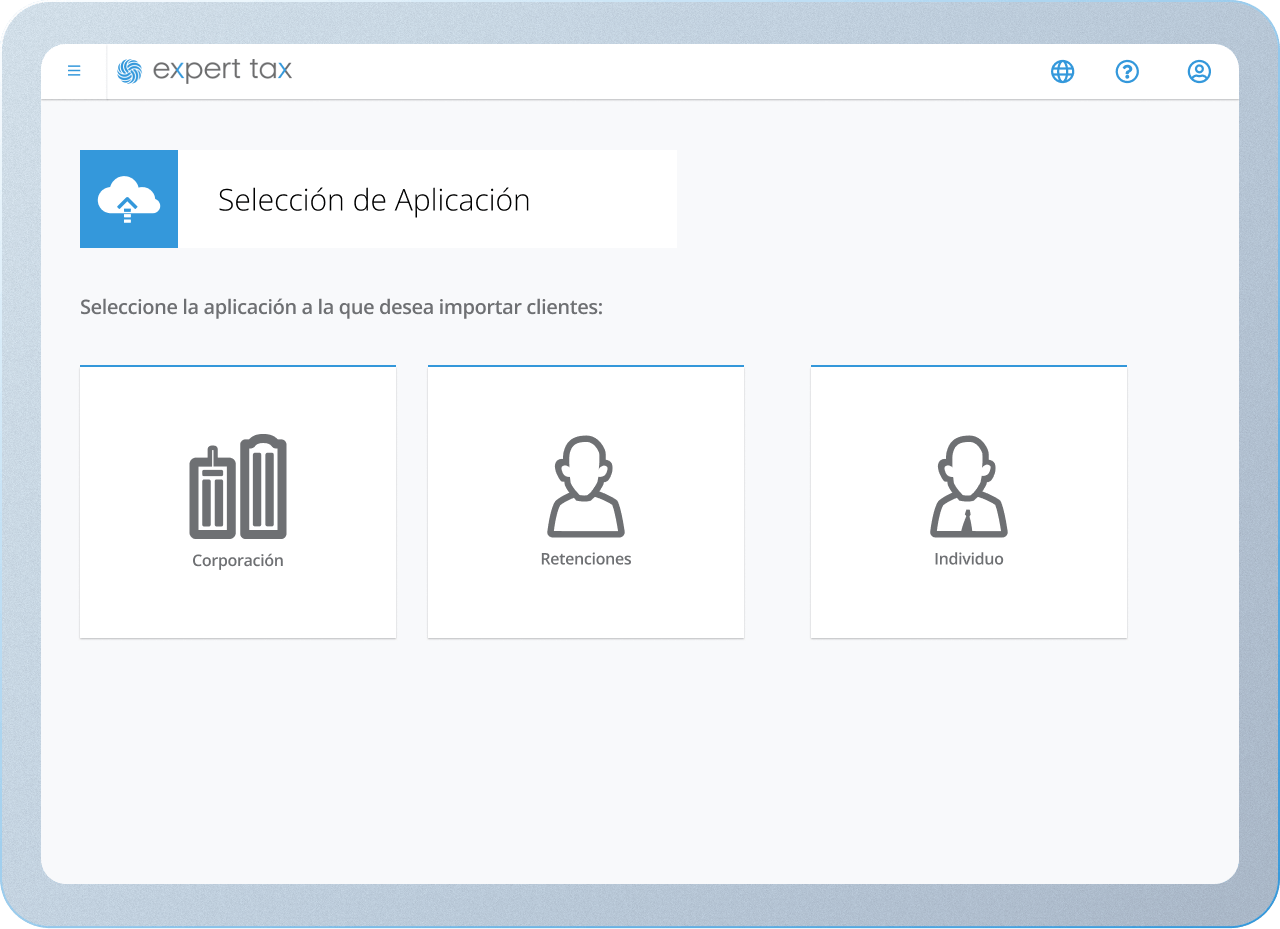

Corporation

The most comprehensive tax preparation software for corporate returns

Fill in all the corporate forms you need

All returns are in the cloud so that you and your team can work from anywhere online.

Not only is it easy to understand and use, but it also makes it easy to navigate between tax forms and clients.

Features that make a difference

Streamline your processes

Discover the features that will take your firm to the next level.

Corporation Module

To fill in all the corporate forms that your clients need.

Single Practioner

Electronic filing in an economic package with a limit of one user.

Filing cost varies per form.

Filing cost varies per form.

$

100/year

Payment plan available

482 - Individual Income Tax Return (Form 482)

480.2 - Corporation Income Tax Return

480.7(OE) - Income Tax-Exempt Organization Information Form

480.2(EC) - Pass-through Entity Income Tax Form

Corporation

10 free filings per account.

$26.90 per electronic filing.

$26.90 per electronic filing.

$

500/year

Payment plan available

480.2 - Corporation Income Tax Return

480.2(EC) - Pass-through Entity Income Tax Form

480.7(OE) - Income Tax-Exempt Organization Information Form

480.1(SC) - Corporate Income Reporting Form

Add-On Incentives

Corporate tax return add-on for Businesses with Tax Exemption Decrees. E-file soon available (New)

$26.90 per e-file.

$26.90 per e-file.

$

250/year

Payment plan available

New consolidated form 480.3(II) available to file electronically for the first time in tax year 2023

480.3(II) - Income Tax Return for Businesses with Tax-Exempt Status (new consolidated form)

Unlimited Corporation Package

Unlimited filing of corporate returns for your account.

$

3,000/year

Per company

Returns

All the corporate forms you need

Returns

Corporation

Add-On Incentives

Annual Corporate Report

480.1(SC) - Corporate Income Reporting Form

480.2 - Corporation Income Tax Return

480.2 (Option 94) - Corporate Income Tax Return (Option 94)

480.20(U) - Corporations and Partnerships Act 154-2010

480.7(OE) - Income Tax-Exempt Organization Information Form

482(C) - Combined Schedule of Partners and Individual Members of Partnerships and Limited Liability Companies

AS-29 - Movable Property Tax Schedule

OCAM - Turnover Statement

SC 2225 - Monthly Tax Return

480.2(EC) - Pass-through Entity Income Tax Form

VOB - Business Volume Statement (Municipal Patent)

480.3(II) - Income Tax Return for Businesses with Tax-Exempt Status (new consolidated form)

Start your free trial today!

Don't get left behind! Experience working from the cloud. You will notice the difference.

Free trial, no commitments